CIF & FOB: Incoterms you need to know when importing from China

Many supply chains range from buyers in Germany to all over the world. Internationally applicable trade clauses, so-called Incoterms, ensure legal security among the partners. Which ones are cheaper for local buyers? CIF Incoterms or FOB Incoterms? The answer is in the details.

Incoterms in international trade in goods

Fair trade in goods is based on rules that the partners involved agree on and adhere to. When it comes to cross-border trade, we speak of International Commercial Terms, or Incoterms for short. They were first established in 1936 by the International Chamber of Commerce (ICC). They are now revised and updated every ten years. The most recent reform came into force on January 1, 2020. Incoterm contracts are not mandatory, but are concluded on a voluntary basis. But then they are binding.

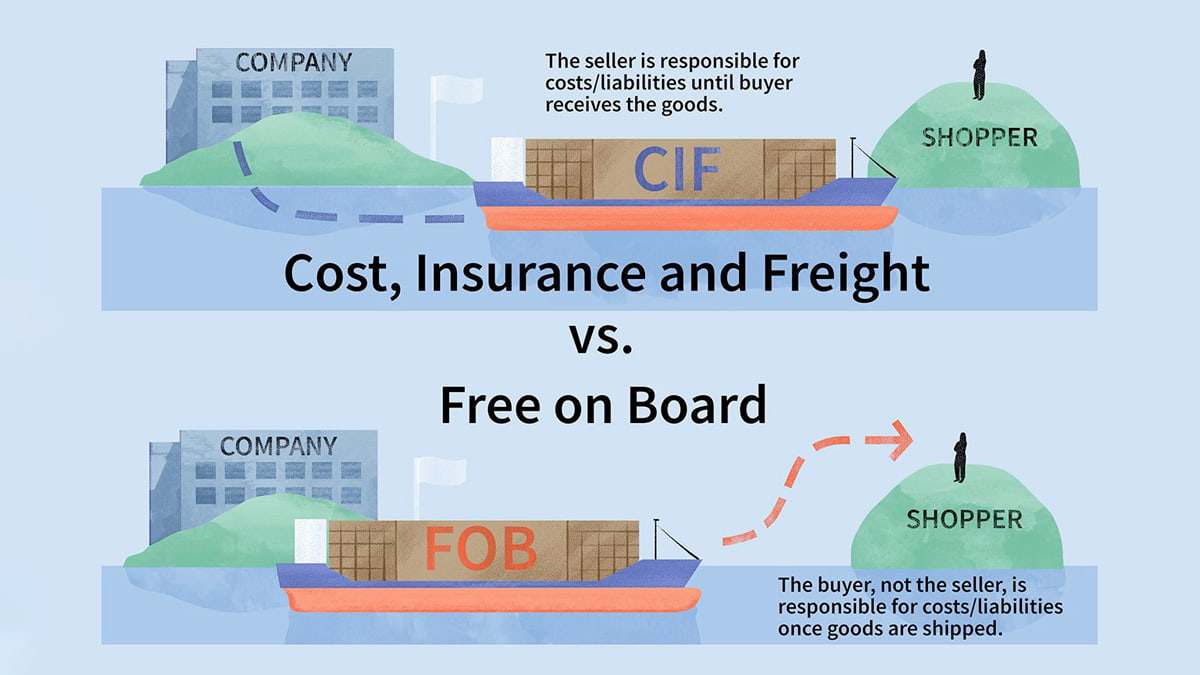

There are a total of eleven Incoterms, two of which are particularly important for maritime transport. That is why they play a major role in doing business with Chinese suppliers, for example . This refers to the Incoterms CIF for Cost, Insurance and Freight and FOB for Free On Board. They describe which obligations buyers and sellers have to fulfill in which phase of trading.

In essence, it is about the question of who is responsible for the goods until they arrive at the port of destination (transfer of risk). This concerns the takeover of:

- Transportation costs

- Insurance costs

-

Shipping risks

CIF: Obligations of the buyer and seller

According to the CIF Incoterms, the seller, i.e. the supplier, is largely responsible for the freight and the resulting costs. In detail, he has the following obligations until the ship has entered the port of destination of the buyer:

- Deliver the goods

- Provision of the necessary documents

- International transport in the exporting country to the port of destination in the importing country

- Assumption of costs for customs in the exporting country

- Departure fee of the ship

- Insurance coverage

The transfer of risk from the seller to the buyer takes place upon arrival at the port of destination. He is responsible for:

- Paying for the goods

- Assumption of costs for incoming goods

- Assumption of costs for customs in the importing country

- Transport in the importing country

- Assumption of the other costs incurred

CIF and FOB: a subtle difference

Compared to the CIF Incoterms, the FOB Incoterms partially shift the responsibilities between the purchaser and the supplier. Accordingly, the obligations for the seller are as follows:

- Deliver the goods

- Provision of the necessary documents

- Transport in Export Country

- Assumption of costs for customs in the exporting country

- Departure fee of the ship

This results in the following responsibilities for the buyer:

- Paying for the goods

- International transport from the port of departure to the port of destination

- Assumption of costs for incoming goods

- Payment of costs for customs in the importing country

- Transport in the importing country

- Insurance coverage

- Assumption of the other costs incurred

The difference between CIF Incoterms and FOB Incoterms: Under FOB terms, responsibility for the international delivery of ocean freight is transferred from the seller to the buyer. This means that he bears the transport costs and risks and is responsible for the transport modalities,For example, you plan to import a batch of electric toothbrushes from China, and when the goods arrive at your designated port, you will need to pay for the goods, in addition to customs and other fees. Therefore, from a procurement perspective, the CIF Incoterms may appear simpler and more practical. And at first glance, they are often cheaper too. Nevertheless, FOB Incoterms can be more beneficial for the procurer.

- The buyer gets control of the transport costs and risks of the goods earlier and can, for example, choose a carrier for the delivery himself. So he has more possibilities to influence costs, insurance, freight and is therefore less dependent on the corresponding agreements of the seller. Because he does not necessarily act in the interests of the buyer.

- Especially when doing business with Chinese partners, the CIF costs often do not stay as low as initially expected. This is due to the following practice of some exporters: They insert a customs agent in the supply chain who is the recipient on the waybill. He only hands over the goods to the buyer in the port of destination. This means that the customer has no right to the delivery beforehand. In addition, the customs agents sometimes charge high premiums for the handover, which they share with the seller and which can significantly increase the total price. This practice is now used not only in China, but also in other countries, for example in Latin America. In these circumstances, FOB Incoterms are often cheaper for the buyer.

As a professional manufacturer of electric toothbrush and oral irrigator / water flosser, Shenzhen Relish provides various types of electric toothbrush wholesale and OEM customized services. You can also wholesale water flosser from Relish at factory price. We can provide you highly competitive prices and look forward to working with you.

- All comments(0)

日本語

日本語 Español

Español Deutsch

Deutsch 中文

中文